Thomas Allen, Practice Transitions Group's co-founder and managing partner, shares his perspective on the evolving healthcare practice market and what owners can expect in 2024.

The Market Evolution: 2023 in Review

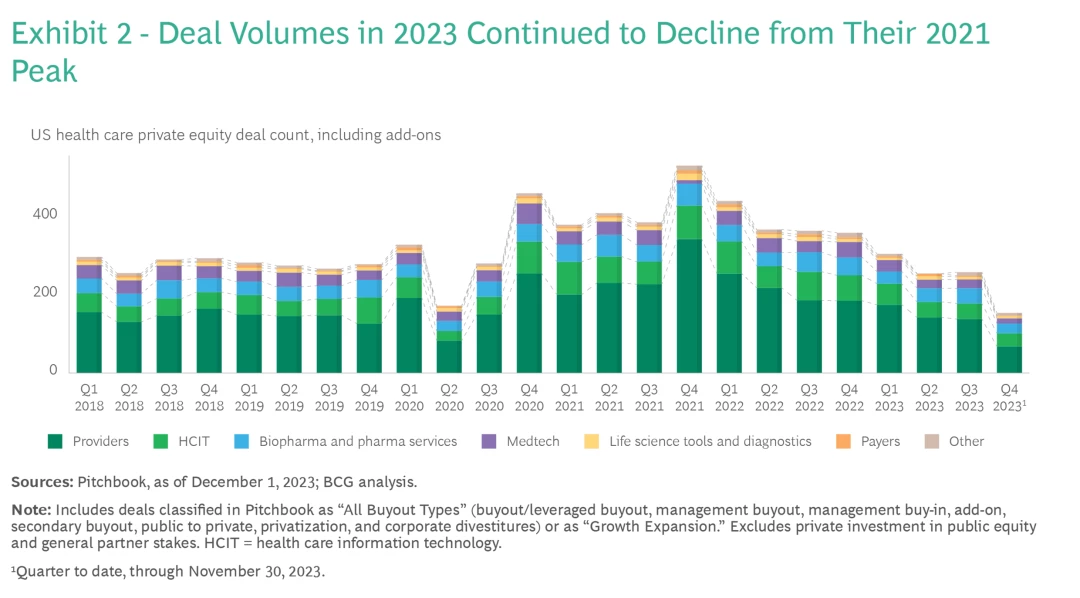

The healthcare practice market underwent a significant shift in 2023, largely shaped by the aftermath of 2021-2022's buying frenzy. After an aggressive expansion during those years, many dental service organizations (DSOs) and healthcare groups faced new challenges as rising interest rates impacted debt costs and operational complexities emerged from rapid growth.

Buyers became notably more selective, conducting deeper due diligence than in previous years. Deals that might have attracted ten bidders in 2021 often saw half that number in 2023, as groups became more discriminating in their approach.

However, premium practices continued to attract strong interest with competitive valuations. These standout practices typically featured strategic locations, clean financial records, strong earnings history, and business-minded leadership. Conversely, practices in secondary markets, those heavily reliant on single providers, or those with limited transition timeline availability experienced longer deal timelines.

Looking Ahead: The 2024 Landscape

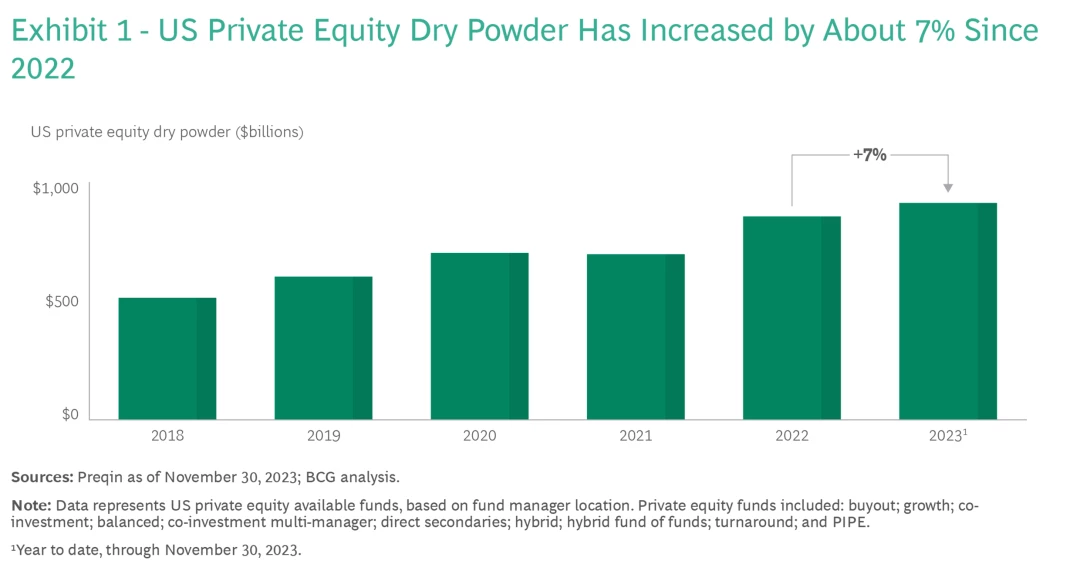

The market is expanding beyond traditional dental-only groups, with private equity firms taking a more holistic view of healthcare investments. MedSpa and plastics sectors are gaining significant momentum, and cross-vertical opportunities are emerging. Well-managed groups continue to attract premium valuations, highlighting the importance of operational excellence.

Market conditions are increasingly highlighting the distinction between strong and weak operators. Successful groups maintain their acquisition pace, while those struggling with debt costs and operational challenges are falling behind. Practice support capabilities and track records of successful integrations have become critical factors in valuations.

While the peak multiples of 2021-2022 may not return, strong practices continue to see competitive valuations. Strategic buyers remain willing to pay premiums for quality practices, and potential interest rate improvements could boost activity in the coming year.

What Practice Owners Should Consider for 2024

For practice owners considering a sale or partnership, these factors will be crucial for success:

- Ensure clean financials and strong operations

- Research potential buyers' operational track records

- Prepare for thorough due diligence

- Consider market timing carefully

- Maintain strong staff retention and patient satisfaction

- Document consistently strong earnings

- Build relationships with potential strategic partners

- Keep equipment and technology current

The healthcare practice market continues to offer attractive opportunities, but success increasingly depends on proper preparation and finding the right partner match. While valuations remain strong for well-run practices, buyers are more focused than ever on sustainable operations and clear growth potential.

The most successful transitions will come from practices that maintain operational excellence while preparing thoughtfully for a potential transaction. Work with experienced advisors who understand both the clinical and business aspects of your practice to maximize your opportunities in this evolving market.