Whether you're actively considering selling your medical spa or planning for the future, understanding how to maximize your practice's value is crucial. Drawing from our experience with over 100 successful healthcare practice transitions, we've compiled key strategies that consistently drive higher valuations and better terms for MedSpa owners.

Building a Self-Sustaining Operation

The foundation of a valuable MedSpa is its ability to operate independently of the owner. Think of successful franchises - the owner isn't handling day-to-day operations. Instead:

- Aim for owner revenue generation of 20-30% versus 60-70%

- Implement comprehensive standard operating procedures

- Train managers to handle operations, scheduling, and inventory

- Develop multiple skilled providers to maintain consistent revenue

Financial Management That Drives Value

As your practice grows beyond $700,000-800,000 in annual revenue, professional financial management becomes essential. Buyers look for:

Clear Performance Tracking

- Revenue by service type (neurotoxins, lasers, IV therapy)

- Location-specific performance for multi-unit operations

- Membership and recurring revenue metrics

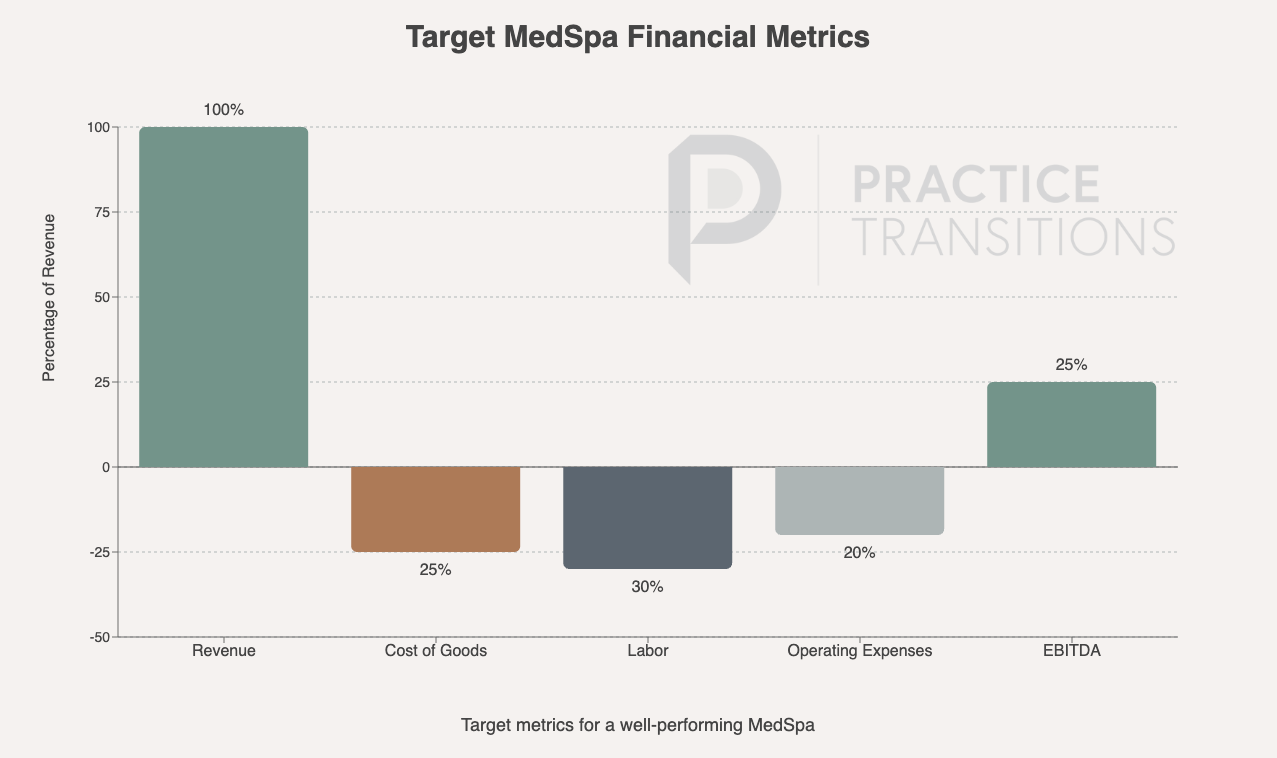

Key Performance Indicators

- Revenue benchmarking (industry average ~$1.7M/year)

- Cost of goods (maintain below 30-40%)

- Labor costs (target below 50%)

- Profit margins (healthy range: 25-30%)

Diversifying Revenue Streams

Single-service dependency can significantly impact valuation. Consider:

- Implementing membership programs (can add $20,000-30,000 monthly)

- Balancing service offerings across:

- Injectable treatments

- Laser procedures

- Wellness services

- Retail products

- Tracking performance metrics for each revenue stream

Understanding Valuation Factors and EBITDA Multiples

Well-run MedSpas typically command EBITDA multiples of 4-7x. Factors that drive higher multiples include:

- Consistent historical performance

- Staff stability and quality

- Prime location demographics

- Operational independence from owner

- Revenue diversity and predictability

Note: Single-provider practices often struggle to achieve even 2x multiples due to transition risk.

Timeline and Transaction Structure

Most successful transitions include:

- Due diligence period (minimum 2-3 months)

- Standard deal elements:

- 10% holdback provisions

- Performance metrics

- Transition period agreements

- Non-compete clauses

Maximizing Exit Value

Early Planning - 3+ Years Out

Start positioning your practice for sale at least 3 years before your intended exit. This allows time to:

- Optimize operations

- Build strong financial records

- Develop staff capabilities

- Address any compliance issues

- Establish competitive advantages

Creating Competitive Tension

Working with an M&A advisor who is exclusively compensated by you, the seller, ensures their interests align with maximizing your outcome. We consistently see that creating competition among qualified buyers leads to better terms and higher valuations than direct offers.

Professional Representation

While many buyers present their initial offer as "market rate," experience shows that professional representation typically drives meaningful improvements in both price and terms. The key is having an advisor who:

- Understands the MedSpa market dynamics

- Can effectively position your practice's value

- Maintains relationships with qualified buyers

- Creates competitive tension to maximize terms

- Represents only seller interests

Next Steps

Whether you're planning to sell in the near term or simply building for the future, focusing on these fundamentals will increase your practice's value and marketability. For a confidential discussion about your specific situation, reach out to our team of healthcare transaction specialists.

About Practice Transitions Group

We specialize in maximizing value for healthcare practice owners through our comprehensive M&A advisory services. Our success-based model means we only succeed when you do, and our exclusive focus on seller representation ensures our interests align completely with achieving your goals.